In our previous article (Partnering 101), we provided an overview of all the components needed for effective biopharma collaborations. In this article, we want to dive into how to actually implement an effective partnering operations.

Sourcing

The first practice to implement is a mechanism to collect and curate key information needed for industry collaborations. The 2 most significant data points to start with are company profiles and their assets. There is a particular set of metadata to collect which makes landscaping and target identification more efficient. The goal is to find a balance between manageable dataset, data quality, and consumable insights. If you don’t have sufficient inputs, then your quality and insights will suffer; likewise, if you look at a wide range of data, it may lead to diluted quality and distractions.

We’ve prepared a template where you can easily start your landscaping exercise – connect with us.

There are a variety of industry data sources and market research providers out there; depending on the classification of data required, you will likely need few different sources to put together the full picture – i.e. company financials, pipeline, available assets, etc.

We have also curated a launched drug profiles dashboard to enrich your dataset.

Triaging

Once you have collected relevant dataset on synergistic companies and assets, the next step is to put in place techniques to sort through that data and filter down precise list of companies to reach out to.

One commonly used technique is to take the results of your landscaping exercise and drill down from that dataset. Here are steps we prescribe to that can guide you also:

- Filter and group your data points using identifiable qualifiers like modality, development phase, indications, MOA, etc.

- Take that output and rank the companies of interest using criterias most relevant to you. Create a top-10 list and filter out the rest for future reference.

- Focus on building a business case around your top choices.

Our template will provide a starting point – give us a shout.

Business Case Preparation

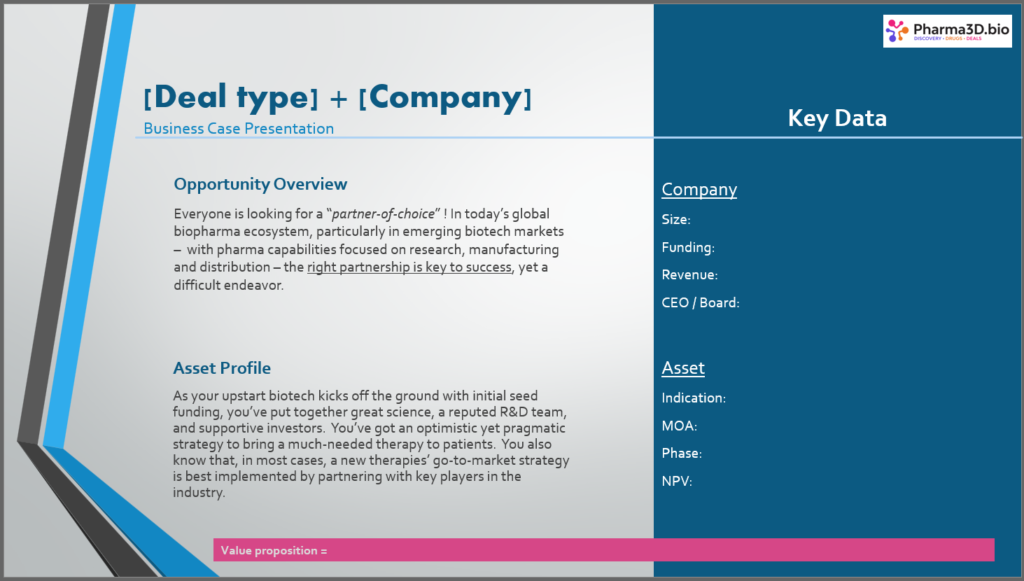

You have now screened through the haystack and determined a handful of companies that fit your strategy. You’re now ready to present these opportunities to key stakeholders and need to put together a business case for each. Management generally prefers to look at business cases presented in precise and digestible executive summaries. The goal for you is to filter the noise and provide a concise set of data points that convey the potential value of each deal. You presentation should capture the following:

- Overview of the opportunity, highlighting the key factors that makes this company attractive

- Overview of the asset and why licensing/acquiring/collaboration on it adds value

- Key metadata on the company, such as: Funding, stock price, key board members

- Key metadata on the asset, such as: Therapy area, MOA, indication, phase

- Key criterias used for screening, such as: NVP, probability of success

We’ve sorted through many pitch decks and constructed a template that optimally captures the message for the C-suite audience. Like what you see, get our template.

BD Transaction Management

Once you’ve passed the business case approval, it’s time to put a CDA in place and start deal discussions. You now need to start thinking about your transaction and diligence teams, and prepare a project plan. This is a whole new ball game that requires its own whitepaper – and we’ll share that soon.

We know what you’re thinking: easier said than done. You’re already wearing multiple hats and have your hands full trying to scale the organization – let us help you.